Your payslip contains important information. Understand how to read it and how to report if you think it might be wrong

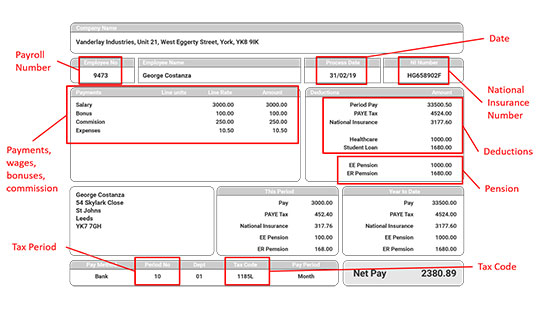

Some companies use payroll numbers to identify individuals on the payroll and it’s important to know to quote to your payroll department or HMRC

The date your pay should be credited to your bank account is usually shown.

This number represents the tax period for that payslip. For example, if you’re paid monthly, 01 = April and 12 = March.

Your tax code will be sent to you by HM Revenue & Customs (HMRC). The code tells your employer how much tax-free pay you should get before deducting tax from the rest. If the code is wrong, you could end up paying too much or too little tax, so you should check this against your latest tax code letter. If you have a job when you’re a student you may need to pay Income Tax and National Insurance.

Your employer will usually deduct Income Tax and National Insurance from your wages through Pay As You Earn (PAYE).

Find more information about what you need to know to get your tax right and to understand how student loan repayments work after graduation.

This is your personal number for the whole of the social security system. It’s used to make sure all your contributions are recorded properly and helps to build up your entitlement to state benefits such as pensions.

This will show how much you have earned in wages before any deductions are made. It might also show how your pay was calculated, for example, your hourly rate and the number of hours worked.

Your payslip must show the amount of variable deductions, such as tax and National Insurance.

If you’re paying towards a workplace pension that your company has set up or arranged access to, the amount you’re contributing will be shown. If your employer is contributing too, that amount might also be shown.

It’s important to keep your payslips in a safe place as they contain a lot of personal information about you and your earnings, including your National Insurance number. Keep them safe to help avoid them being used for identity fraud.

It’s a good idea to keep a record of all your earnings and tax payments in case there’s a problem and you need to check old details.

For some financial products, such as loans, you might be asked to prove your earnings by showing your last three payslips.

Your NI number ensures your NI contributions and tax are recorded against your name. You can find your number in:

Your P60 shows the tax you’ve paid on your salary in the previous tax year (6 April to 5 April). If you have more than one job, you will get a separate P60 for each of your jobs.

If you’re working for an employer on 5 April they must give you a P60. They must provide this by 31 May, on paper or electronically.

You’ll need your P60 to prove how much tax you’ve paid on your salary so you can:

You can check how much tax you paid last year if you think you might have paid too much.

Please keep all your P60s for future reference

If you’ve paid tax and stop working part way through the tax year you may be able to claim a refund.

Use HMRC’s tax checker to find out if you might have paid too much tax, or contact HMRC:

Tel: 0300 200 3300

Tel (outside UK): +44 135 535 9022